Saturday, December 26, 2009

Analysis of Q3 Results for Junior Oil and Gas Companies on the TSX: Part One

Friday, December 25, 2009

Question 10 - How will your auditors ensure your Cash Generating Unit’s will be authenticated?

Question 9 - How can your auditors potentially make your IFRS conversion pay for itself and add asset value to your company?

Question 8 - Do your auditors authenticate well counts for Annual Information Form’s?

Question 7 - How do your auditors tie up reserves to cash generating units?

Question 6 - How do your auditors authenticate your Asset Retirement Obligation’s and Offset well liabilities?

Saturday, December 19, 2009

Question 5 - How Do Your Auditors Validate Your Are Not Overpaying Capital, Operating Expenses or Royalties?

How do your auditors validate that you are not overpaying:

a. Capital?

b. Operating expenses?

c. Royalties?

Sunday, December 13, 2009

Question 4 - How do your auditors validate that you are receiving what is owed to you?

Saturday, December 12, 2009

Question 3 - How do your auditors validate that your working interests are accurate in all your cost centers?

Wednesday, December 2, 2009

Question 2 - Cost Centers to Assets Match - Part of the 10 Questions An Oil and Gas Company Should Ask Their Auditors

This is the second question in the list of ten questions to ask your auditor if you are a Canadian based oil and gas company. The original post can be found here.

The question was:

How do your auditors tie up every cost center to your assets?

Cost centers allow companies to put the appropriate expenditures against the appropriate budget. This question can probably be best answered by asking a few more questions.

How can you auditors tie up cost centers to assets if they can’t create an authentic asset list or well list?

If your auditor cannot tie up cost centers, then how can they authenticate expenditures?

If you cannot tie up expenditures, then how do you know exactly what your company is spending?

Pretty straight forward, no match to an asset, then there is a possibility that errors can creep in.

Sunday, November 29, 2009

Question 1 - Authenticated Master Well List - Part of the 10 Questions An Oil and Gas Company Should Ask Their Auditors

In my last post, 10 Questions An Oil and Gas Company Should Ask Their Auditors, I listed off 10 questions that Auditors should be asked to get an understanding of how they approach auditing your financials. This is especially critical as TSX listed oil and gas companies are about to start the switch to International Financial Reporting Standards.

How do your auditors authenticate your master asset list or well list to ensure accuracy?

This is an important question to ask your auditor, as an oil and gas company’s primary asset typically will be their reserves. Hard to believe, but there are few companies that even have an accurate master wells list. Smaller companies typically do, if they have high ownership and few wells, but Argentis Group had one client with production of about 300 barrels a day who stated that they had 59 gross wells and 56 net wells in their Annual Information Form (AIF) when in fact we uncovered over 200 gross wells and 56 net wells. Of the 56 net wells that they claimed they had, we had 20% different wells then they listed. Another firm that Argentis Group worked with had just gone through a 3-month process of creating a master well list, but we were still able to identify 4% of their wells missing of the newly made master list and 2% of the overall proved reserves missing.

The reason that companies do not have an accurate master well list is that there may be several different departments that keep a well list (no two being the same in most cases) and no true owner of the well list. For example, the Land department and the reserves department may have a list, engineering might have a list and finance might say that their Asset Retirement Obligation (ARO) list might be the well list, but basically, there is no authentic master well list.

In order for an auditor to do their job thoroughly and to have a starting point, they should have a process to look at a master well list with meta data such as working interests, royalty rates, operatorship, etc. I know that in reality the auditor only has to take the information that you provide and authenticate it, but for the fees that they charges, they should at least be able to help with a master well list.

If your auditor doesn’t have a process for assisting you create a master well list, then how do they know that you ARO’s and the wells on the ARO List are accurate. If your auditor doesn’t have or can’t compile a master well list, then they don’t know your reserves and how do they know if all your reserves are being tied up to a cash generating unit?

If you look at a company having an inaccurate master well list, then they are more than likely understating or overstating Depletion, Depreciation and Amortization (DD&A) costs. For example, let’s say that a company has $100 DD&A costs overall and you have 10 BOE as reserves. This translates to $10/BOE in DD&A. If you find 2 more BOE in reserves that you didn’t know you had, then you end up with $8.33/BOE in DD&A, which is derived from $100 (total DD&A costs) divided by 12 BOE (the new amount of reserves). In this case, the oil and gas company is overstating their DD&A costs by 20%. In addition, this company will now be able to increase their Net Asset Value (NAV) by potentially 20% through the additional reserves that were found.

The bottom line is, if your auditors don’t have a master well list or have no way of providing you with a master wells list, then they are doing you a disservice. You should be demanding more from your audit firms and be asking for more rigor in their process. If they can’t provide you with an accurate well list and help boost your overall value of your company, then you should look for a firm that will help you. Argentis Group can help create the accurate well list for your company.

These opinions are mine and may not reflect your view. If you would like to contact me, then please feel free to do so at info@argentis-group.com. Argentis Group assists oil and gas companies with operational audits to identify areas to reduce costs, increase revenues and increase the overall asset value of an oil and gas company.

Friday, November 27, 2009

10 Questions An Oil and Gas Company Should Ask Their Auditors

With the introduction of International Financial Reporting Standards (IFRS) in Canada the financial landscape will be changing for publicly listed companies in January 2011 or just a little over a year. As such, companies would be wise to review not only how they are audited and how they will report, but also who is actually doing their financial audits for them.

Listed below are ten questions that you should ask your auditor. I will go into more detail as to why you should ask these questions in subsequent posts.

Top 10 Questions An Oil and Gas Company Should Ask Their Auditors

1. How do your auditors authenticate your master asset list or well list to ensure accuracy?

2. How do your auditors tie up every cost center to your assets?

3. How do your auditors validate that your working interests are accurate in all your cost centers?

4. How do your auditors validate that you are receiving:

a. All revenue due to you?

b. All royalties due to you?

c. All transportation, processing fees and compression fees due to you?

5. How do your auditors validate that you are not overpaying:

a. Capital?

b. Operating expenses?

c. Royalties?

6. How do your auditors authenticate your Asset Retirement Obligation’s and Offset well liabilities?

7. How do your auditors tie up reserves to cash generating units?

8. Do your auditors authenticate well counts for Annual Information Form’s?

9. How can your auditors potentially make your IFRS conversion pay for itself and add asset value to your company?

10. How will your auditors ensure your Cash Generating Unit’s will be authenticated?

The numbers for the top 5 audit firms in Calgary are listed below.

Deloitte – 403-267-1700

E&Y – 403-290-4100

KPMG – 403-777-9999

PWC - 403-509-7500

MNP - 403-444-0150

Give your auditor a call and see if they can answer these questions for you. If they can not provide a thorough check against all results then you should ask them how they are going to do this to ensure accuracy as you move towards IFRS.

Argentis Group can perform a full array of operational audits to assist companies in identifying opportunities to help offset the costs of IFRS for oil and gas companies and also allow you to ensure financial accuracy. Typically, we will find enough value for your company to more that offset the costs and to make you transition to IFRS smoother and potentially allow for greater overall financial strength.

These opinions are mine and may not reflect your view. If you would like to contact me, then please feel free to do so at info@argentis-group.com. Argentis Group assists oil and gas companies with operational audits to identify areas to reduce costs, increase revenues and increase the overall asset value of an oil and gas company.

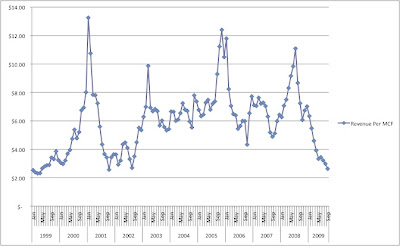

The High Cost of Natural Gas - Potentially Breaking the Bank

- Q2 2009 numbers that I have shown in the past show that the average sales price is $6.34/mcf

- The average price for natural gas since 1999 was $5.90/mcf Canadian

- The average price for natural gas since 2006 has been $6.44/mcf Canadian

- The average price for natural gas over the last 12 months has been $4.64/mcf Canadian

- In 2008, the National Energy Board of Canada claimed that the average cost per mcf for companies was $7.63 Canadian

- Intermediate oil companies (between 10,000 and 100,000 BOED) had an average cost of $7.07 Canadian (excluding royalties)

- Juniors (between 500 and 10,000 BOED) had an average cost of $9.27/mcf Canadian (excluding royalties)

- In US dollars the average price of natural gas on the NYMEX was $5.43/mcf and $4.67/mcf on the AECO - This represents a NYMEX premium of 14%

- In US dollars, since 2006, the average price of natural gas on the NYMEX was $6.77/mcf and $5.86/mcf for the AECO - This represents a NYMEX premium of 13%

- In US Dollars, over the last 12 months (Oct 08 to Sept 09), the average price of natural gas on the NYMEX was $4.54/mcf and $3.93/mcf for the AECO - This represents a NYMEX premium of 14%

Sunday, November 22, 2009

No Two Companies are the Same - Cash Flow Analysis on Canadian Oil and Gas Companies

| Company | Size | Cash Flow | Cash flow/ Share | Cash flow/ BOED | Cash flow Per BOE |

| CrescentPoint | Intermediate | $137,960,000 | $0.92 | $3,339 | $36.29 |

| ParamountEng | Intermediate | $88,718,000 | $0.78 | $3,216 | $34.96 |

| Freehold | Junior | $21,884,000 | $0.44 | $3,000 | $32.97 |

| West | Junior | $12,063,000 | $0.15 | $2,948 | $32.40 |

| Peyto | Intermediate | $46,063,000 | $0.43 | $2,562 | $27.84 |

| Fairborne | Intermediate | $35,742,000 | $0.41 | $2,335 | $25.38 |

| NAL | Intermediate | $52,972,000 | $0.52 | $2,298 | $24.98 |

| Zargon | Junior | $21,325,000 | $0.92 | $2,240 | $24.62 |

| Baytex | Intermediate | $86,661,000 | $0.82 | $2,146 | $23.32 |

| Enerplus | Intermediate | $199,815,000 | $1.18 | $2,114 | $22.98 |

| Daylight | Intermediate | $48,459,000 | $0.45 | $2,103 | $22.85 |

| Culane | Junior | $3,032,000 | $0.13 | $2,049 | $22.51 |

| Bonterra | Junior | $9,780,000 | $0.55 | $1,951 | $21.43 |

| Bonavista | Intermediate | $101,655,000 | $0.85 | $1,964 | $21.34 |

| Pengrowth | Intermediate | $160,095,000 | $0.62 | $1,948 | $21.18 |

| ARC | Intermediate | $120,500,000 | $0.51 | $1,884 | $20.48 |

| Galleon | Intermediate | $29,605,000 | $0.39 | $1,842 | $20.02 |

| Delphi | Junior | $12,371,000 | $0.16 | $1,817 | $19.97 |

| Arcan | Junior | $2,764,000 | $0.07 | $1,815 | $19.94 |

| Celtic | Intermediate | $20,008,000 | $0.46 | $1,834 | $19.94 |

| Birchcliff | Intermediate | $20,026,000 | $0.18 | $1,770 | $19.24 |

| EagleRock | Junior | $916,000 | $0.02 | $1,738 | $19.10 |

| Fairwest | Junior | $1,388,000 | $0.01 | $1,716 | $18.85 |

| Advantage | Intermediate | $51,590,000 | $0.36 | $1,662 | $18.06 |

| NuVista | Intermediate | $41,779,000 | $0.53 | $1,621 | $17.62 |

| Rock | Junior | $5,195,000 | $0.20 | $1,561 | $17.15 |

| BlackPearl | Junior | $8,013,000 | $0.03 | $1,550 | $17.03 |

| Seaview | Junior | $3,076,000 | $0.05 | $1,489 | $16.36 |

| Stonefire | Junior | $2,037,000 | $0.08 | $1,488 | $16.35 |

| Crew | Intermediate | $20,036,000 | $0.27 | $1,488 | $16.17 |

| Zapata | Junior | $3,853,000 | $0.23 | $1,461 | $16.05 |

| Painted Pony | Junior | $1,826,000 | $0.06 | $1,391 | $15.28 |

| Diaz | Junior | $822,000 | $0.01 | $1,218 | $13.38 |

| NuLoch | Junior | $601,000 | $0.02 | $1,185 | $13.03 |

| Angle | Junior | $8,539,000 | $0.21 | $1,143 | $12.56 |

| Great Plains | Junior | $1,486,000 | $0.02 | $1,142 | $12.55 |

| Open Range | Junior | $2,508,000 | $0.09 | $1,117 | $12.28 |

| TRUE | Junior | $10,765,000 | $0.14 | $1,102 | $12.11 |

| Trilogy | Intermediate | $21,857,000 | $0.22 | $1,104 | $12.00 |

| Breaker | Junior | $7,493,000 | $0.16 | $1,064 | $11.70 |

| Storm | Junior | $8,460,000 | $0.18 | $1,038 | $11.40 |

| Buffalo | Junior | $2,743,000 | $0.04 | $1,011 | $11.11 |

| Cequence | Junior | $1,541,000 | $0.04 | $995 | $10.94 |

| Cinch | Junior | $2,569,000 | $0.05 | $982 | $10.79 |

| Redcliffe | Junior | $747,000 | $0.01 | $944 | $10.38 |

| Twin Butte | Junior | $2,691,000 | $0.06 | $940 | $10.33 |

| Crocotta | Junior | $1,884,000 | $0.04 | $939 | $10.32 |

| Midnight | Junior | $2,054,000 | $0.04 | $938 | $10.31 |

| ProspEx | Junior | $2,864,000 | $0.05 | $927 | $10.19 |

| Wrangler West | Junior | $1,034,000 | $0.16 | $926 | $10.17 |

| Berens | Junior | $3,866,000 | $0.04 | $925 | $10.16 |

| Yoho | Junior | $2,475,000 | $0.12 | $923 | $10.14 |

| Terra | Junior | $4,930,000 | $0.07 | $911 | $10.01 |

| Arsenal | Junior | $2,032,000 | $0.02 | $909 | $9.99 |

| ParamountRes | Intermediate | $12,236,000 | $0.19 | $916 | $9.95 |

| Questerre | Junior | $717,000 | $0.004 | $890 | $9.78 |

| Progress | Intermediate | $29,619,000 | $0.18 | $876 | $9.52 |

| Anderson | Junior | $6,692,000 | $0.06 | $859 | $9.44 |

| Enterra | Intermediate | $8,561,000 | $0.14 | $851 | $9.25 |

| Vero | Junior | $5,767,000 | $0.15 | $819 | $9.00 |

| Petro-Reef | Junior | $619,000 | $0.02 | $731 | $8.03 |

| Ironhorse | Junior | $877,000 | $0.04 | $717 | $7.88 |

| Midway | Junior | $673,000 | $0.05 | $687 | $7.55 |

| Intl Sovereign | Junior | $593,000 | $0.04 | $622 | $6.83 |

| Orleans | Junior | $2,326,000 | $0.04 | $604 | $6.64 |

| Sure | Junior | $372,000 | $0.01 | $570 | $6.26 |

| Bellamont | Junior | $394,000 | $0.01 | $454 | $4.99 |

| Triton | Junior | $420,000 | $0.01 | $447 | $4.92 |

| Fortress | Junior | $557,000 | $0.02 | $435 | $4.79 |

| Compton | Intermediate | $9,214,000 | $0.07 | $430 | $4.67 |

| Twoco | Junior | $511,000 | $0.03 | $403 | $4.43 |

| Monterey | Junior | $844,000 | $0.03 | $362 | $3.98 |

| Insignia | Junior | $273,000 | $0.02 | $353 | $3.88 |

| Canext | Junior | $347,000 | $0.004 | $349 | $3.83 |

| Iteration | Intermediate | $5,464,000 | $0.03 | $319 | $3.47 |

| DeeThree | Junior | $95,000 | $0.01 | $176 | $1.93 |

| Canadian Phoenix | Junior | $149,000 | $0.0001 | $169 | $1.86 |

| Argosy | Junior | $78,000 | $0.01 | $83 | $0.92 |

| Second Wave | Junior | $(26,000) | $(0.001) | $(26) | $(0.29) |

| Result | Junior | $(32,000) | $(0.0004) | $(52) | $(0.57) |

| Dejour | Junior | $(243,000) | $(0.003) | $(439) | $(4.82) |

| One | Junior | $(355,000) | $(0.01) | $(529) | $(5.81) |

| Action | Junior | $(855,000) | $(0.01) | $(880) | $(9.67) |

| Average | $18,687,410 | $0.19 | $1,180 | $12.91 |

Followers

Blog Archive

-

▼

2009

(30)

-

▼

December

(10)

- Analysis of Q3 Results for Junior Oil and Gas Comp...

- Question 10 - How will your auditors ensure your C...

- Question 9 - How can your auditors potentially mak...

- Question 8 - Do your auditors authenticate well co...

- Question 7 - How do your auditors tie up reserves ...

- Question 6 - How do your auditors authenticate you...

- Question 5 - How Do Your Auditors Validate Your Ar...

- Question 4 - How do your auditors validate that yo...

- Question 3 - How do your auditors validate that yo...

- Question 2 - Cost Centers to Assets Match - Part o...

-

▼

December

(10)