Here are some interesting numbers on Natural Gas production in Western Canada:

- Q2 2009 numbers that I have shown in the past show that the average sales price is $6.34/mcf

- The average price for natural gas since 1999 was $5.90/mcf Canadian

- The average price for natural gas since 2006 has been $6.44/mcf Canadian

- The average price for natural gas over the last 12 months has been $4.64/mcf Canadian

- In 2008, the National Energy Board of Canada claimed that the average cost per mcf for companies was $7.63 Canadian

- Intermediate oil companies (between 10,000 and 100,000 BOED) had an average cost of $7.07 Canadian (excluding royalties)

- Juniors (between 500 and 10,000 BOED) had an average cost of $9.27/mcf Canadian (excluding royalties)

- In US dollars the average price of natural gas on the NYMEX was $5.43/mcf and $4.67/mcf on the AECO - This represents a NYMEX premium of 14%

- In US dollars, since 2006, the average price of natural gas on the NYMEX was $6.77/mcf and $5.86/mcf for the AECO - This represents a NYMEX premium of 13%

- In US Dollars, over the last 12 months (Oct 08 to Sept 09), the average price of natural gas on the NYMEX was $4.54/mcf and $3.93/mcf for the AECO - This represents a NYMEX premium of 14%

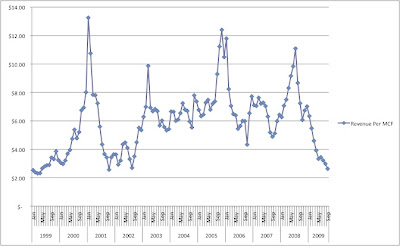

Below shows a graph of the monthly price of natural gas in Canadian dollars since 1999.

Above shows the price of natural gas since 2006 on a monthly basis in Canadian Dollars.

So no matter how you cut it, Western Canadian Gas is at a significant price and cost disadvantage. If we are pulling a mcf of gas out of the ground for $7.63 on average and we are getting a significantly lower price, $4.64/mcf (based on an average of the last 12 months), then you are losing $2.99/mcf and this isn't much of an economic business model. This example represents a 39% difference in price just to break even.

Over the long term the price of natural gas is, on average, lower than the current costs to extract it. Something has to be done to reduce the cost per mcf as we have very little impact over price of natural gas since it is market driven.

These opinions are mine and may not reflect your view. If you would like to contact me, then please feel free to do so at info@argentis-group.com. Argentis Group assists oil and gas companies with operational audits to identify areas to reduce costs, increase revenues and increase the overall asset value of an oil and gas company.

No comments:

Post a Comment